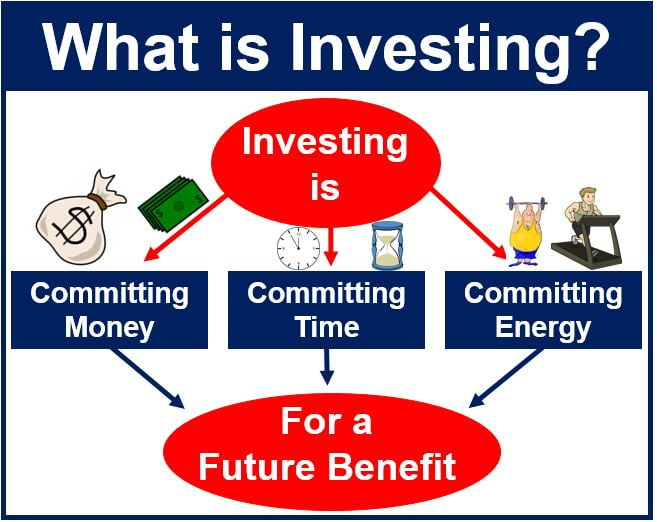

Investments are the allocation of money or resources into things like projects, businesses, or other things with the hope of making money or returns later on. There are many distinct types of investments, including:

* Market risk: This is the chance that the value of all investments will decrease as a result of a decline in the market as a whole.

* Specific risk: This is the risk that an investment won't perform as well as anticipated because of elements unique to that business or sector.

* Liquidity risk: This is the chance that, should the need arise, you won't be able to swiftly sell your investment.

* Credit risk: This is the possibility that the investment's borrower won't be able to pay back the loan.

Depending on the type of investment and the particular conditions, the level of risk associated with a certain investment will change. However, there is some risk associated with every investment.

You can take a number of steps to manage investment risk, such as:

|

| Manage investment |

* Diversifying your portfolio: This means investing in a variety of different assets, which can help to reduce your overall risk.

* Investing for the long term: This can help to smooth out the ups and downs of the market and reduce your risk of loss.

* Doing your research: Before you invest, make sure that you understand the risks involved and that you are comfortable with them.

Remember that there is no investment that is completely risk-free. However, you can improve your chances of success by properly limiting your risk.

Here are some other pointers for controlling investing risk:

* Start small: If you have never invested before, it is a good idea to do so. As you gain confidence in your ability to manage the risks, you can progressively increase your investment amount.

* Rebalance your portfolio regularly: This means selling some of your winners and buying more of your losers, which can help to keep your portfolio balanced and reduce your risk.

* Don't panic sell: If the market takes a downturn, it is important to stay calm and not panic sell. Selling your investments when they are down will only lock in your losses.

These suggestions can help you reduce investing risk and improve your chances of success.

|

| saving VS investment |

Diversifying your portfolio: This means investing in a variety of different assets, which can help to reduce your overall risk.

* Investing for the long term: This can help to smooth out the ups and downs of the market and reduce your risk of loss.

* Doing your research: Before you invest, make sure that you understand the risks involved and that you are comfortable with them.

Remember that there is no investment that is completely risk-free. However, you can improve your chances of success by properly limiting your risk.

Here are some other pointers for controlling investing risk:

* Start small: If you have never invested before, it is a good idea to do so. As you gain confidence in your ability to manage the risks, you can progressively increase your investment amount.

* Rebalance your portfolio regularly: This means selling some of your winners and buying more of your losers, which can help to keep your portfolio balanced and reduce your risk.

* Don't panic sell: If the market takes a downturn, it is important to stay calm and not panic sell. Selling your investments when they are down will only lock in your losses.

These suggestions can help you reduce investing risk and improve your chances of success.

|

| invest & saving |

How to invest and save

Saving money and investing can be done in a variety of ways. Popular choices comprise:

* Savings accounts: Saving money in savings accounts is a low-risk strategy. They normally have low interest rates, but they also have a high level of security.

* Certificates of deposit (CDs): CDs are a sort of savings account that provide a greater interest rate than a conventional savings account. However, you usually have to put your money in a lockbox for a set amount of time, like a year or five years.

* Money market funds: These mutual funds, which invest in short-term debt instruments, are one form. Though they are a little riskier, they often offer a greater interest rate than a conventional savings account.

* Stocks: Stocks represent ownership stakes in businesses. If you believe in the future success of a particular firm, investing in its stock can be a smart decision. However, it's essential to be aware that stocks can also experience rapid fluctuations, making them inherently volatile investments. Therefore, it's crucial to carefully assess the risks and do thorough research before making any investment decisions in the stock market.

* Bonds: Bonds are a form of lending where individuals provide loans to businesses or governments. Compared to stocks, bonds generally carry less risk, making them a more stable investment option. However, it's important to note that while bonds offer a higher level of security, they often provide smaller returns compared to the potential gains one can experience from investing in stocks. Investors often include bonds in their portfolio to achieve a balanced approach to risk and returns.

Before you save or invest your money, it is crucial to complete your homework. You should be aware of the dangers and make the best investing decision possible given your unique situation.

Investing vs. Speculation

|

Investing vs. Speculation |

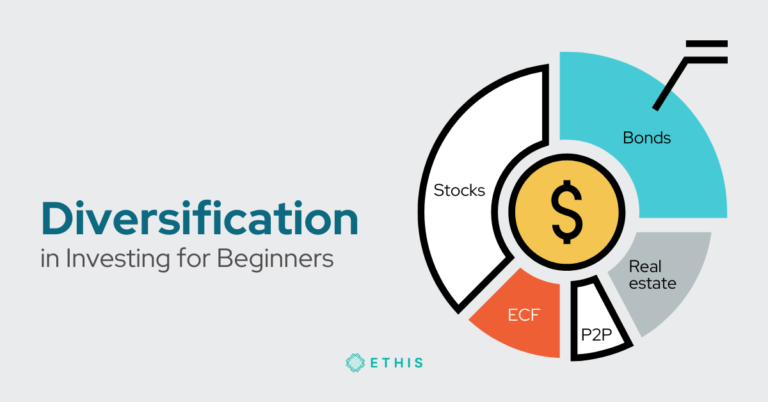

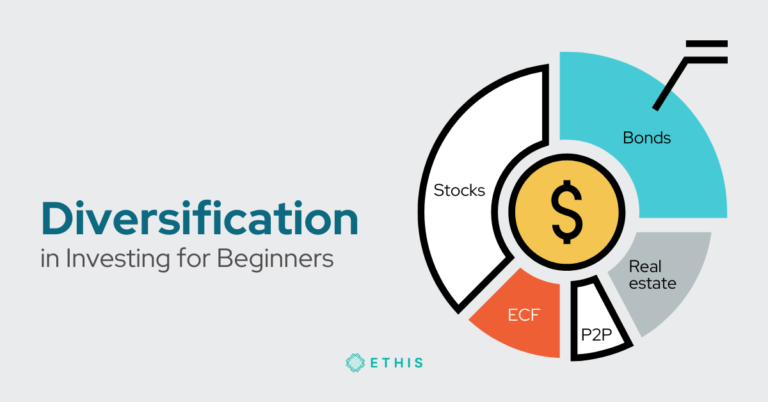

Spreading your money throughout several asset classes, industries, and geographical areas is a key component of the investment approach known as diversification. This can help lower your overall risk because diversification makes it less likely that a market downturn will have a large impact on your portfolio.

Your financial portfolio can be diversified in a variety of ways. Popular techniques include:

* Investing in various asset classes: Asset classes are groups of investments that include equities, bonds, real estate, commodities, and so on. You can lower your risk by dispersing your funds throughout several asset classes and markets by investing in a number of asset types.

* Investing in various industries: An industry is a collection of businesses that operate in a single economic area. By distributing your money among several businesses and sectors, investing in many industries might lower your risk.

* Investing in various geographic areas: The world's regions are referred to as geographic areas. You can lower your risk by investing in several geographic areas and dispersing your funds throughout numerous nations and economies.

There is no one-size-fits-all strategy for diversification, it is crucial to remember this. Your unique situation and risk tolerance will determine how much variety you require. However, by diversifying your investing portfolio, you can lessen your overall risk and raise the likelihood that you will succeed in reaching your financial objectives.

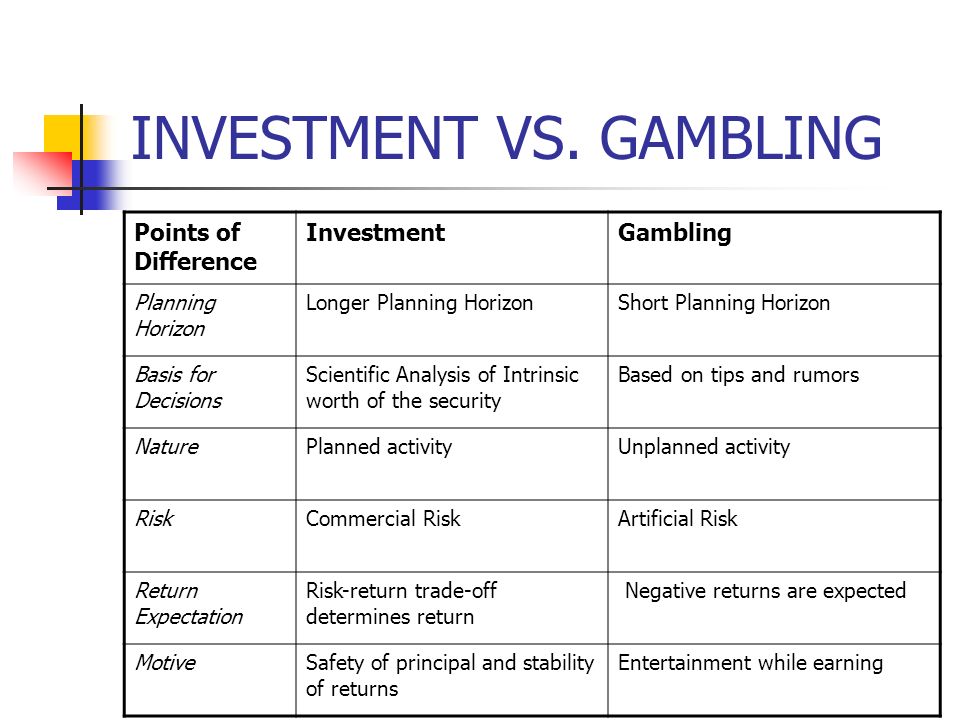

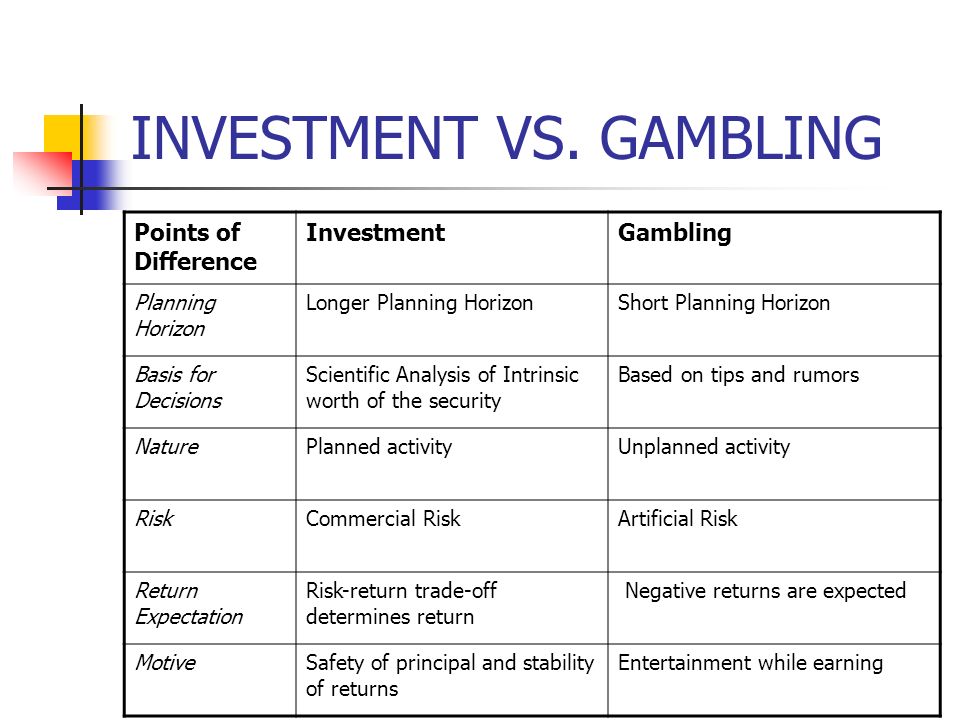

How Can an Investment Be Different From a Bet or Gamble?

A purchase of a good or service with the expectation that it would eventually bring in money or increase in value is known as an investment. A profitable return on investment is anticipated. The outcome of a wager or gamble, on the other hand, is unclear, and while the potential benefits are large, so too are the risks.

The distinction between an investment and a bet or gamble cannot be made with absolute certainty. Some investments, like day trading, can be very speculative and risky. However, some wagers, like those on the result of a sporting event, can be made after doing some study and analysis.

Ultimately, the decision of whether to invest or gamble is a personal one. Investors should carefully consider their risk tolerance, investment goals, and time horizon before making a decision.

Is investing equivalent to gambling?

No, speculating and investing are not the same thing. An asset or thing is considered an investment if it is bought with the expectation that it may one day produce income or increase in value. Buying something with the intention of selling it for more money soon is known as speculation.

Investments and Diversification:

|

| Investments vs Diversification |

Spreading your money throughout several asset classes, industries, and geographical areas is a key component of the investment approach known as diversification. This can help lower your overall risk because diversification makes it less likely that a market downturn will have a large impact on your portfolio.

Your financial portfolio can be diversified in a variety of ways. Popular techniques include:

* Investing in various asset classes: Asset classes are groups of investments that include equities, bonds, real estate, commodities, and so on. You can lower your risk by dispersing your funds throughout several asset classes and markets by investing in a number of asset types.

* Investing in various industries: An industry is a collection of businesses that operate in a single economic area. By distributing your money among several businesses and sectors, investing in many industries might lower your risk.

* Investing in various geographic areas: The world's regions are referred to as geographic areas. You can lower your risk by investing in several geographic areas and dispersing your funds throughout numerous nations and economies.

It's crucial to remember that there is no one-size-fits-all strategy for diversification. Your unique situation and risk tolerance will determine how much variety you require. However, by diversifying your investing portfolio, you can lessen your overall risk and raise the likelihood that you will succeed in reaching your financial objectives.

The following are a few advantages of diversification:

|

| Diversification |

* Reduces risk: You can lower your overall risk by dispersing your funds among several industries, geographic locations, and asset classes. This is due to the fact that diversification makes it less probable for a market slump in one sector to significantly affect your portfolio.

* Increases prospective returns: You can raise your potential profits by diversifying. You are not placing all of your eggs in one basket, which is why. Your other assets may be able to make up any losses if one investment does poorly.

* Increases the stability of your portfolio: Diversification can help increase the stability of your portfolio. This is because you are less dependent on a single asset class or sector of the economy. Your portfolio is less likely to be impacted by a slump in one sector of the market.

The following are some dangers of diversification:

* Costs may rise: Diversification may result in higher investment costs. This is due to the possibility of having to pay commissions to various investment managers or brokers.

* might make tracking your portfolio more challenging: Diversification might make tracking your portfolio more challenging. This is because you will need to keep track of additional investments.

* Can lower your expected returns: Diversification can lower your expected returns. You are not investing all of your money in the most promising assets, which is why this is the case.

Overall, diversity can help you lower your risk and increase the likelihood that you'll reach your financial objectives. However, before choosing how to invest your money, it's crucial to consider the advantages and hazards of diversification.

When you can save money with no risk, why invest?

|

| RISK |

True, there are ways to save money without taking any chances. There are a few reasons, nevertheless, why you might prefer to invest.

Saving money in a savings account will probably give you a very meagre interest rate. This implies that over time, your money won't grow very much. However, you might be able to get a better return if you invest your money. This is due to the fact that investments may increase in value over time.

You can accomplish your long-term financial objectives via investing. Investing can assist you in achieving long-term financial objectives, such as retirement or college funding. This is so that you can save more money and benefit from assets that can grow over time.

You can diversify your assets with the aid of investing. Saving money is akin to placing all of your financial eggs in one basket. This implies that you run the risk of losing all of your money if something occurs to your savings. You can diversify your holdings, though, if you invest your money. This indicates that you are diversifying your investments with your money, which might lower your risk.

|

| Risk free Investment |

NOTE:

Before making any investing selections, one should do extensive research, evaluate their risk tolerance, and take their financial goals and time horizon into account. Getting advice from a financial counsellor or investment specialist can also be very helpful.

The Summary:

The act of investing entails putting money into assets in the anticipation of future income or capital growth. Investments come in a wide variety of forms, such as stocks, bonds, mutual funds, real estate, and commodities.

You may achieve your long-term financial objectives and gradually increase your wealth through investing. However, investment also carries some risk. Your investments' value may increase or decrease, and you could end up in the red.

Author: allykazmi

Nice information

ReplyDeleteGood information keep updating

ReplyDeleteGood 👍

ReplyDeleteInvestment is a good habit

ReplyDeleteGood information

ReplyDelete