financial goals

The Ultimate Guide to Budgeting: How to Take Control of Your Money and Achieve Your Financial Goals

How To Create a Successful Budget

How To Create a Successful BudgetFinancial Goals: A good method to manage your money and make sure you are living within your means is to make a monthly budget. Although each person's budget will differ depending on their unique situation, you can use the following general template to make your own monthly budget:

Financial Goals

1. Calculate your income:

* List all sources of income you receive in a month, such as salary, freelance work, rental

income, etc.

* Add up the total income.

2. Determine your fixed expenses:

* Identify your essential monthly expenses that remain relatively constant, such as:

* Rent/mortgage payments

* Utilities (electricity, water, gas)

* Internet and cable bills

* Phone bill

* Insurance premiums (health, auto, home, etc.)

* Loan repayments (car loan, student loan, etc.)

* The total amount of fixed expenses is added.

3. Figure out your variable costs:

* Costs that vary from month to month are known as variable expenses. Several

instances include:

* Groceries * transit (fuel and fares for public transit) * Dine outside * movie theatres, concerts, etc.) * Clothing * Gifts for personal care * To determine the typical amount you spend on each category of variable expenses,

review your past expenses.

* The projected total variable costs are added.

4. Think about your investments and savings: * It's crucial to set aside some of your income for savings and investing in order to cover emergencies and long-term objectives. * Set up a manageable amount each month and include it in your budget.

5. Calculate discretionary spending:

* Discretionary spending includes non-essential expenses that you have control over,

such as:

* Eating out at restaurants

* Shopping for non-essential items

* Hobbies and recreation

* Set a limit on discretionary spending to avoid overspending and ensure it fits within your

budget.

6. Calculate your overall spending:

* Total up all of your savings, investments, and discretionary expenditures as well as your

fixed and variable costs.

7. Review and make changes:

* Compare your whole expenses to your income. * If your expenses are more than your income, you may need to find some places to cut back or strategies to boost your earnings.Make necessary adjustments to your budget to make it attainable and practical.

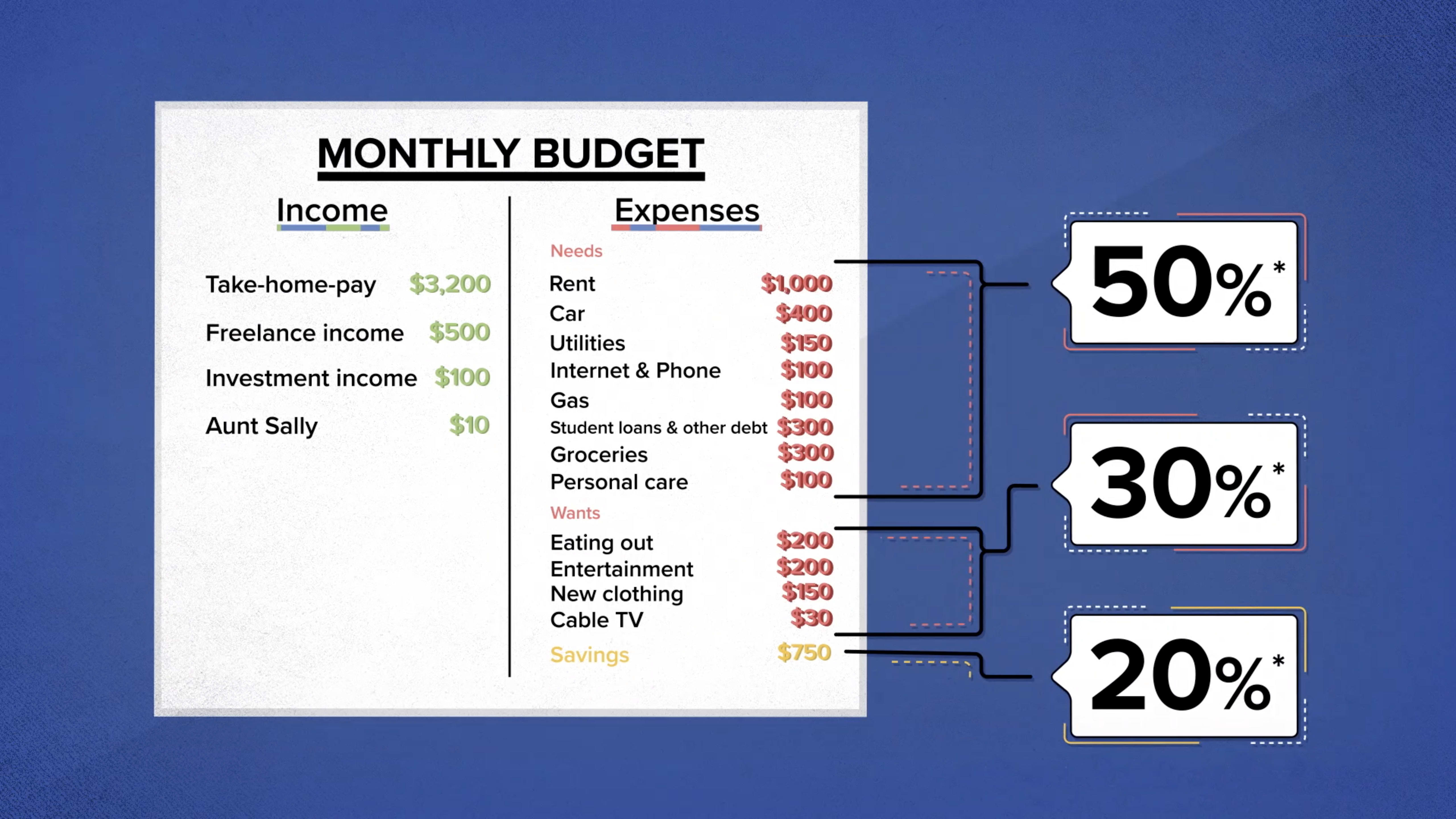

A budget example is shown below:

INCOME

- Salary: $5,000

- Other income: $500

Expenses:

- Housing: $1,000

- Transportation: $500

- Food: $300

- Entertainment: $200

- Debt repayment: $500

- Savings: $500

Total: $5,000

This is just an example, and your budget will vary depending on your individual circumstances. However, this should give you a good starting point for creating your own budget.

|

| Importance of Budgeting |

Why Budgeting Is Important:

It aids with spending management. You can monitor where your money is going and find places to make savings by keeping track of your spending. This can help you achieve your financial goals and save money.

* It helps you keep your finances under control.You may ensure that you are not spending more than you are earning by using a budget. You may increase your savings and prevent debt by doing this.

* It aids you in achieving your financial objectives. Your progress towards your financial objectives, such as saving for a retirement or a down payment on a home, can be tracked with the use of a budget.Your motivation may be strengthened and you may stay on track as a result.

* Your mind is at ease as a result. You may feel more at ease knowing where your money is going and that you are not overspending. You may be able to unwind and appreciate life more as a result.

I strongly recommend that you start budgeting if you aren't already. At first, it may seem like a hard task, but it will be worthwhile in the end. You may take charge of your finances and accomplish your financial objectives with the aid of a budget.

|

| 50\30\20 Rule |

50/30/20 Rule:

Needs: Included in this category are costs for necessities including shelter, transportation, food, and utilities.

Wants: Non-essential costs like entertainment, shopping, and eating out fall under this category.

Savings: The money you set aside for long-term objectives like retirement, a down payment for a home, or an emergency fund falls under this category.

The 50/30/20 rule suggests that you allocate your money as follows:

- Needs: 50%

- Wants: 30%

- Savings: 20%

Budgeting Tips:

|

| Tips To Make Budget |

* Follow your spending: This will allow you to see where your money is going and where you can make savings. You can keep tabs on your spending by writing down your purchases every day, utilising a spreadsheet, or using a budgeting app.

* Be honest: When you're creating your budget, be honest about your income and outgoings. Don't create a rigorous budget that you know you won't be able to follow.

* Be adaptable: Things happen, so be ready to change your budget as necessary. You might need to change your budget to account for an unforeseen expense.

* Automate your savings: Automating your savings is one of the best strategies to save money. This entails setting up a system where funds are routinely sent automatically from your checking account to your savings account. You won't even miss the money this way!

* Don't be afraid to ask for help: If you are struggling to create a budget or stick to one, don't be afraid to ask for help. There are many resources available to help you, such as financial advisors, budgeting apps, and online forums.

CONCLUSION:

Keep in mind that a budget is a flexible tool, so you might need to make adjustments as things develop. Review and monitor your spending frequently to keep on top of your finances and make wise decisions.

I hope these pointers will assist you in setting up a budget.

Author: allykazmi

Useful financial information

ReplyDeleteGood work sir ji

ReplyDeleteIt is good to make budget.good information

ReplyDeleteIt is good to make budget

ReplyDeleteGood information keep updating

ReplyDelete