money management books

Navigating Financial Waters: A Guide to Effective Money Management

|

| Navigating Financial Waters |

Understanding Inflation: Techniques to Protect Your Budget and Financial Well-Being.

For both individuals and corporations, navigating the financial waters and engaging in good money management are vital.When income and expenses are out of balance, it can have a disastrous impact on a person's finances, resulting in stress and financial hardship.Here are some tips to help you efficiently manage your money:

1. Create a Budget: Start by outlining your income and expenses in a budget. To find out where your money is going, keep track of your spending patterns. Set aside money for savings, debt repayment, debt cancellation, and discretionary expenditure. Watch your spending and make any necessary adjustments.

2. Build an Emergency Fund: Save money for unforeseen costs or emergencies. Try to save up three to six months' worth of expenses in a convenient location. This can act as a safety net and prevent needless debt.

3. Prioritise debt management: If you have debts, create a plan to pay them off quickly. Consider consolidation or refinancing options to reduce interest rates, starting with high-interest bills. Make timely payments and refrain from taking on additional debt.

4. Save and Invest Wisely: Establish financial objectives and save a consistent amount of your salary. Depending on your risk tolerance and financial objectives, take into account several forms of savings and investing choices. To spread out risk, diversify your investments and, if necessary, consult a specialist.

5. Spend Responsibly: Be cautious of your money and learn to tell needs from wants. Avoid making rash purchases, and think about delaying making important financial decisions. Search for ways to save money and less expensive options.

6. Automate Finances: Set up automatic payments for bills and savings contributions. This helps ensure that payments are made on time and savings are consistently contributed. Automating finances can also help avoid late fees and encourage disciplined savings habits.

7. Educate Yourself: Keep up with ideas in personal finance and money management. Recognise financial jargon, investment tactics, and fundamentals of financial planning. Prepare for the future by becoming knowledgeable about issues including taxes, insurance, retirement, and estate planning. Making wise judgements will be easier for you now that you are aware.

8. Seek Professional Advice: Think about working with a financial advisor or planner who can offer individualised advice based on your financial condition and goals. They can offer investment advice, help you with complicated financial issues, and construct a thorough financial strategy for you.

9. Monitor and Review: Consistently assess your financial success and make any modifications. Keep tabs on your expenditures, investments, and savings. Review your financial objectives, revise your spending plan, and evaluate your tactics from time to time.

10. Practise Discipline and Patience: Both discipline and patience are necessary for effective money management. Refrain from making rash judgements, adhere to your budget, and exercise patience when pursuing long-term objectives. Creating financial security requires patience and ongoing work.

People's purchasing power decreases when prices rise, so it is critical to tackle inflationary pressures head-on. In this post, we'll examine how inflation affects budgets and offer helpful advice for preserving your financial security in the face of rising prices.

Recognising the Impact of Inflation on Budgets: Inflation is a long-term decline in buying power brought on by a steady rise in the cost of goods and services. A perfect budget is put to the test by this price increase because the anticipated costs might no longer match the real ones.

In order to ensure financial stability, it is important to modify the budget to reflect these changes.

How to Manage Budget Pressures Caused by Inflation:

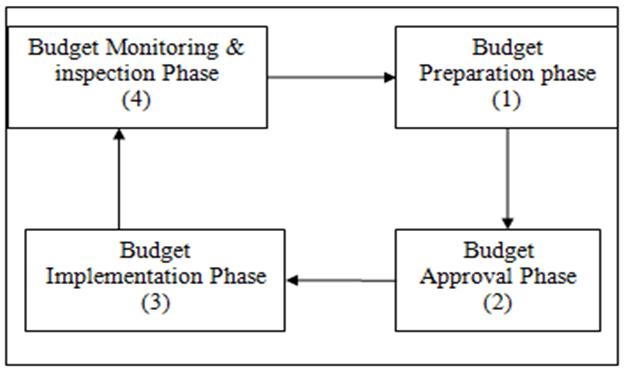

A. Budget Review and Modification: Follow these three crucial measures to make sure your budget is reasonable and flexible in the face of inflation:

|

| Finance for Everyone: Everything You Need to Know |

* Identifying discretionary expenses: Differentiate between necessary and discretionary costs, giving the latter priority for possible reductions.

* Prioritising important needs: Before taking into account discretionary expenditure, evaluate and allocate funds to cover critical costs like housing, utilities, and healthcare.

* Reducing wasteful spending: Examine your budget to find any costs that can be cut back or eliminated without affecting your standard of living.

B. Investigating More Affordable Purchase Options: Examine less expensive purchase options to combat growing prices:

|

| The Power of Money: How to Use It to Achieve Your Goals |

* Shopping comparison: To find the greatest offers, look up and compare costs at various brick-and-mortar and online retailers.

* Requesting discounts and making use of coupons: To reduce costs, take use of coupons, loyalty programmes, and discounts that are offered.

*Exploring online stores: Discover new internet shops to shop at; they frequently have affordable rates and occasionally have special offers.

C. Effective Debt Management: You may lessen the effects of inflation by managing your debt well. Inflation frequently results in higher debt burdens.

|

| Financial Planning: A Guide for the 21st Century |

* Options for refinancing: Take into account refinancing your loans to obtain cheaper interest rates and cut your overall borrowing costs.

* Negotiating interest rates: You can save money over time by speaking with your creditors and negotiating a favourable interest rate.

* Prioritizing high-interest debt repayment: Prioritise paying off debts with high interest rates first to relieve financial pressure and cut back on long-term expenses.

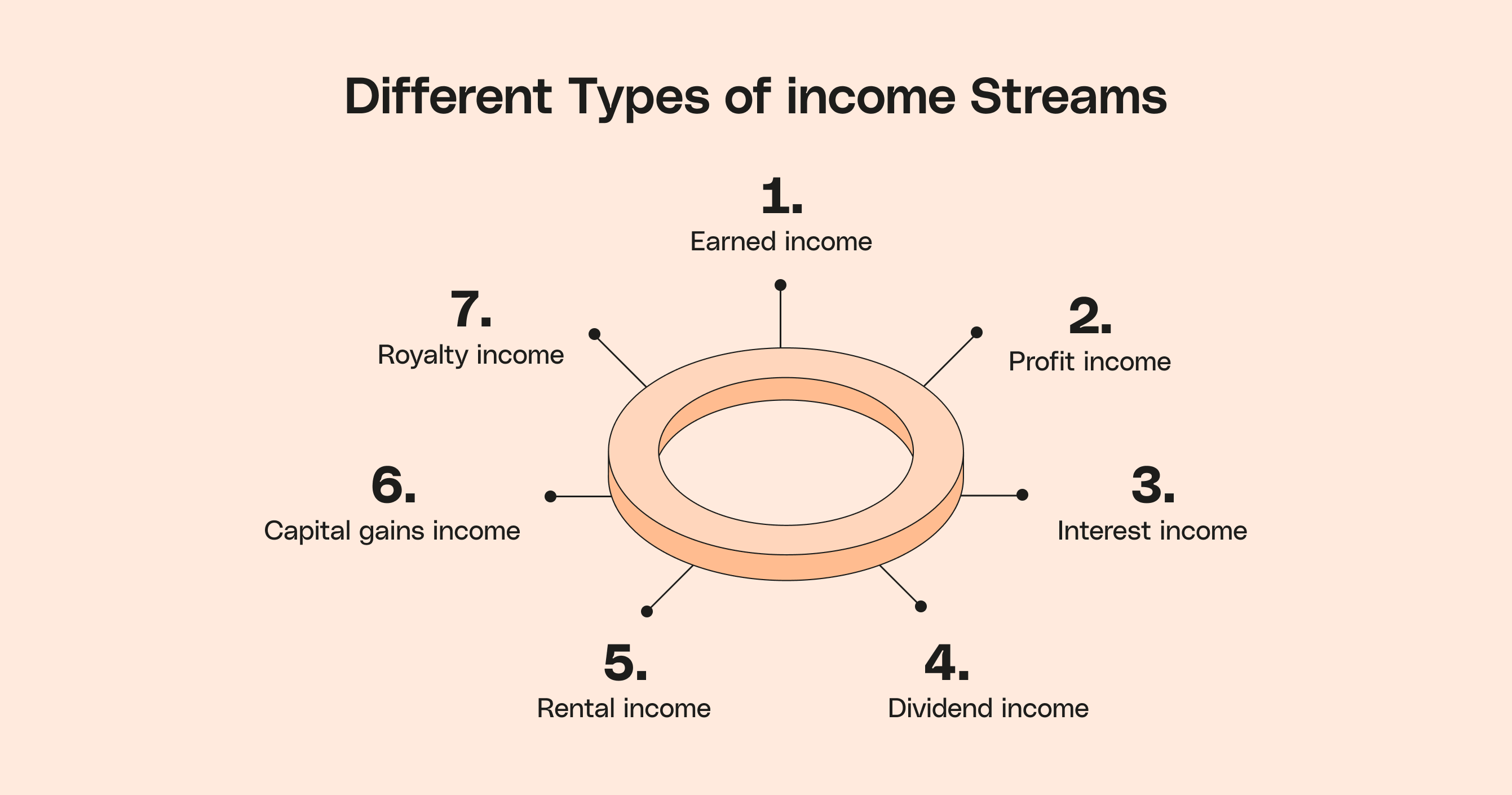

D. Increasing Income Streams: Examine ways to increase your income to stave off the effects of inflation:

|

| The Ultimate Guide to Personal Finance |

* Looking for extra employment opportunities: To supplement your major source of income, you might want to consider working a part-time job or doing freelance work.

* Starting a side business or freelancing: Make use of your knowledge and experience to launch a side business or provide freelance services, creating new income opportunities.

* Utilising current skills for freelance work: Take advantage of your expertise and look into freelance platforms to find assignments that fit your qualifications.

Conclusion:

Because every person's financial situation is different, it's crucial to customise these techniques to meet your individual demands and objectives. You may enhance your financial situation and work towards reaching your financial goals by engaging in efficient money management practises.

This one is really good

ReplyDeleteGreat information

ReplyDeleteGreat information sir keep it up

ReplyDeleteGood information.keep it up.

ReplyDeleteGood information

ReplyDelete